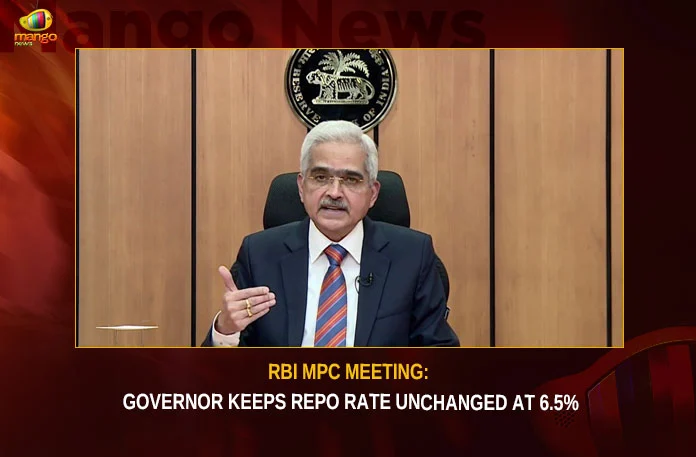

The Reserve Bank of India (RBI) announced its decision on key rates following the conclusion of its three-day Monetary Policy Committee (MPC) meeting. The meeting was headed by Mr. Shaktikanta Das, the Governor of the RBI, following which he addressed a press conference on Thursday, the 8th of June.

In the previous MPC meeting held in April, the RBI decided to pause its rate hike cycle and maintain the repo rate at 6.5%. This time also, considering the inflation and other economic aspects, the MPC decided to keep the repo rate unchanged.

The experts anticipate that the central bank is likely to hold this rate in its upcoming announcement, considering the easing of retail inflation in April and the potential for further decline.

Highlights about the MPC meeting, the MPC decides to keep repo rate unchanged at 6.5%, Standing Deposit Facility Rate remains at 6.25%. In addition, Marginal Standing Facility Rate and Bank Rate unchanged at 6.75%:

Mr. Shaktikanta Das, the Governor of the RBI said, going forward, the RBI would remain nimble in its liquidity management while ensuring ample availability to meet production needs of the economy.

Mr. Shaktikanta Das said, “Goal is to reach the targeted 4% inflation going forward, our monetary policy actions are yielding desired results giving us space to keep rates unchanged in this meeting.”

Furthermore, retail inflation projection lowered to 5.% from an earlier estimate of 5.2% in April policy decision.

FY24 5.1% (Projection) 5.2% (Earlier)

Q1FY24 4.6% (Projection) 5.1% (Earlier)

Q2FY24 5.2% (Projection) 5.4% (Earlier)

Q3FY24 5.4% (Projection) 5.4% (Earlier)

Q4FY24 5.2% (Projection) 5.2% (Earlier)

GDP growth estimate for FY24 remained at 6.5%

RBI growth outlook

FY24 6.5% (Projection) 6.5% (Earlier)

Q1FY24 8% (Projection) 7.8% (Earlier)

Q2FY24 6.5% (Projection) 6.2% (Earlier)

Q3FY24 6% (Projection) 6.1% (Earlier)

Q4FY24 5.7% (Projection) 5.9% (Earlier)

Mango News Link

Telegram: https://t.me/mangonewsofficial

Google Play Store: https://bit.ly/2R4cbgN

Apple / iOS Store: https://apple.co/2xEYFJ