Our nation is a cash-based economy. Though some believe that we are not ready to become digital economy it might be happening sooner than we think. Now, why is this so? The answer to this is Jan Dhan Yojna launched by our Prime Minister Narendra Modi, on August 2014, there was a whopping increase in the number of the bank account. At a total of 25.45 crores, this is mostly due to the availability of zero balance accounts.

In India, 95% of the transactions by volume and 65% by value are made in cash. Though cash is difficult to carry, people have preferred this over other options. But of late this has been changing. With a large population, it has almost become next to impossible for the government to keep a track of this physical currency.

The fake currency being pushed into our country from different sources is something the government has no control over. The astonishing thing is that the paper manufacturer who supplies to RBI and this counterfeit currency is same. What is the most logical step our government can take in such situation? Demonetisation.

A nation where only 3% of the population pay their taxes and in that 3 %, 66% that becomes 2% of our population files for returns this was the only next logical step for getting revenue for India to grow as a superpower.

Is this the first time Demonetisation happened in India? And the answer is NO. It has happened two times before, once in 1946 and other in 1978.

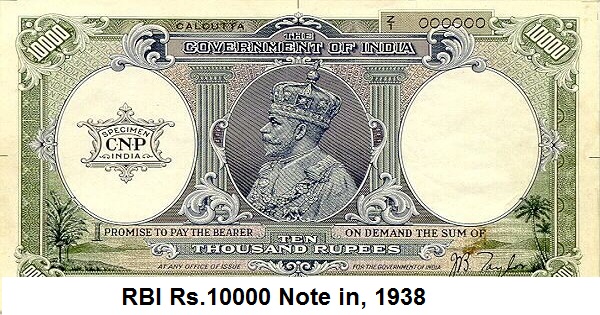

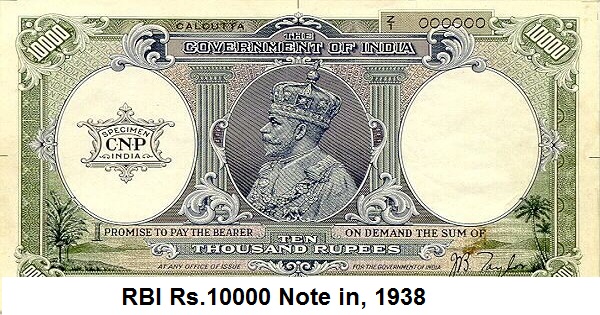

Demonetisation 1946

The British Government In India introduced a Rs.10000 note in 1938. this was by far the largest denomination to be printed. This was demonetised along with Rs500, 1000 notes in 1946. This came as a shock to Independent India as it affected all classes of men. People began to sell these notes at 60 and 70 percent of their value.

The Result of this demonetisation was the replacement of Rs.143 crores with new notes and lower denominations becoming a huge success.

Demonetisation 1978

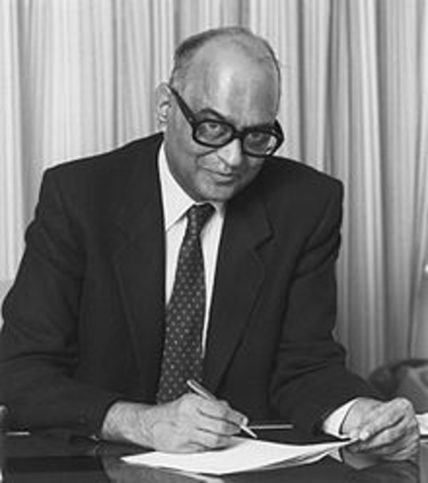

In 1954 the RBI introduced new Rs. 500, 1000, Rs.5000 and 10000 notes, which were then demonetised in 1978 by Janta Parivar government led by Sri Morarji Desai. This was preceded by the emergency situation India faced and the downfall of Indira Gandhi led Congress.

On January 16, 1978, to curb the black money that made a return after Emergency situation, R.Janaki Raman, a senior official at RBI announced this on All India Radio.

This was a curbing attempt more than conversion that happened in 1946. This attempt was a failure as the lower and middle-class men were not in the position of hoarding cash. The upperclassmen and hoarder received an intimation beforehand making this attempt a failure.

Demonetisation 2016

Though too early to judge if it a success or failure the government is taking many steps to make this transition an easy process. In order to do this, the government introduced Income Declaration Scheme where an individual can declare his black money and pay 45% tax on the total amount and turn it into white. The government maintained the secrecy of all details about the people in this scheme. This scheme pulled in a total sum of Rs.30000 Crores, which is by far the biggest success.

There has been no demonetisation after 1978, and even after the opening of the conservative economy in 1991 tax evaders have found lots of ways to hoard cash which in turn was disturbing the economy in stabilizing rupee against dollar. This is a hope to stabilize and increase the value of our currency.