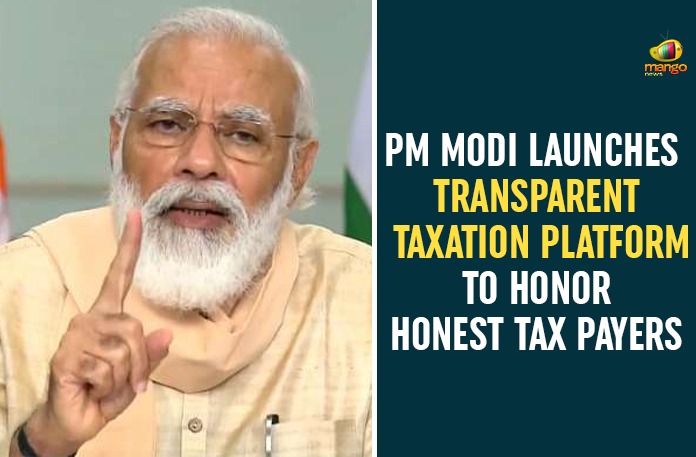

The Prime Minister of India on the 13th of August, launched the ‘Transparent Taxation- Honoring the Honest’ platform.

Prime Minister ‘Narendra Modi launched the platform as an initiative to honor ones who were honestly paying their taxes.

Mr. Modi during the launch said, “The ‘Transparent Taxation – Honoring The Honest’ platform will bring in faceless assessment, faceless appeal, and taxpayers’ charter. Faceless assessment & taxpayers charter come in force from today, whereas faceless appeal service will be available from September 25.”

Mr. Modi launched the new platform through video conferencing.

Mr. Modi said, “In the last six years, focus has been on banking the unbanked and securing the unsecured. Today, a new journey begins – honouring the honest.”

The new platform would be a boon for honest tax payer as it would benefit them.

The main features are faceless assessment, faceless appeal and tax payers’ charter. The main focus of launching the platform is to make the tax system “people-centric and public friendly.”

During the video conference, Mr. Modi said, “It strengthens our resolve of minimum Government, maximum governance.” He further added, “The emphasis is on making every rule-law, policy people-centric and public friendly. This is the use of the new governance model and the country is getting its results.”

The initiative would ease compliance for tax payers with proper use of technology and maintaining transparency.

While it would help tax payers, the launch is a a problem for the income tax administration.

In regard to this, the representative of the Income Tax Employees Federation and Income Tax Gazetted Officers’ Association wrote a letter to the Central Board of Direct Taxes (CBDT.)

In the letter, the association said, “We express our strong displeasure on this type of unilateral decision-making as it is not in the interest of the efficient working of the Department.”